Investing Profile

Alexander Galitsky

VCInvestorFounderCEO

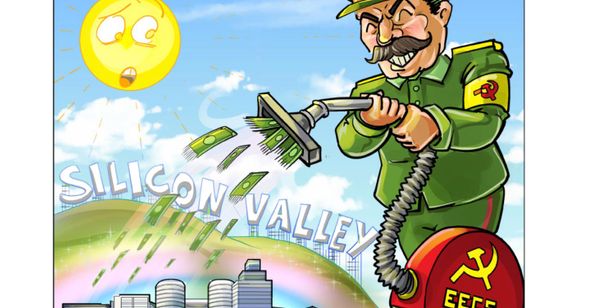

Brining startups from emerging tech regions to the global marketplace

almazcapital.comCalifornia

Your Intro Paths to Alexander Galitsky

Signal uses Gmail to reveal intro paths. Email content is never read.

Sign in with Google →Current Investing Position

Almaz Capital Managing Partner

Investment Range

$1M - $10.0M

Sweet Spot

$5.0M

Investments On Record

70

Alexander Galitsky is on these Sector & Stage Rankings

Alexander Galitsky's Investments On Record (43)

| Company | StageDateRound Size | Total Raised |

|---|---|---|

Neptune.io | Series AApr 2022$8M | $8M |

Minut | Series BMar 2022$14M | $22M |

Refurbed | Round BAug 2021$54M Series AMar 2020$17M | $190M |

FinalPrice | Seed RoundJul 2021$1M Seed RoundJun 2017$4M | $5M |

OneSoil | Series AApr 2021$5M | $5M |

Esperanto Technologies | Convertible NoteApr 2021$61M Series BNov 2018$58M | $120M |

ZEDEDA | Series AMar 2021$13M Series AFeb 2019$16M Seed RoundFeb 2018$3.1M | $100M |

3Dlook | Series AMar 2021$6.5M | $6.5M |

Alexander Galitsky's Media (4)

most interested in

I am interested in companies that are keenly focused on bringing their solution to the global marketplace versus focusing on regional opportunities. The second criteria is a B2B market. Typically, I invest in B2B deep tech startups that create unique technology and quickly respond to market signals and pivot if necessary.not interested in

I do not currently engage in synthetic biotech and quantum computing. I certainly feel these two areas are up-and-coming and reserve the right to pivot should opportunities present. Still, at the current time, they are not in focus. Likewise, I do not deal at the moment with any cryptocurrency projects.Alexander Galitsky's Experience

Board Member Octonion2017 - Present

Board Member Parallels2014 - Present

Board Member Jelastic PaaS2012 - Present

Board Member Skolkovo Foundation2010 - Present

Co-founder Almaz Capital2007 - Present

Investors who invest with Alexander Galitsky

Founders who looked at Alexander Galitsky's profile also looked at these Scouts & Angels